Parents • Self-Employed • Cash Earners • Side Hustlers

We help everyday people file taxes accurately, legally, and stress-free especially families with children and non-traditional income.

Free Tax Review

Fast Filing

Secure

Affordable

WHY CHOOSE US

We Work With Both Households and High-Income Earners Whether you’re paid by W-2, 1099, equity, royalties, distributions, commissions, bonuses, crypto, or asset-based compensation, we ensure your income is reported correctly, protected legally, and optimized for maximum return.

Most tax firms only understand paychecks. We understand remuneration.

What Sets Us Apart

We specialize in complex income structures Stock options, RSUs, bonuses, deferred compensation, contract income, trusts, royalties, crypto, and business distributions are all handled with precision.

We protect families and wealth builders From Child Tax Credits to multi-stream earners, we know how to structure filings so nothing is left on the table — and nothing triggers unnecessary audits.

We report non-W2 income the right way Entrepreneurs, consultants, content creators, traders, landlords, and private contractors trust us to classify income correctly and defensively.

We maximize refunds — legally Our strategy is compliance-based, not gimmicks. We reduce tax liability while keeping your filings bank-, lender-, and IRS-ready.

We think like underwriters, not storefronts Your tax return isn’t just a form — it’s a financial profile that impacts your credit, funding, real estate, and wealth strategy.

18+ years of professional tax expertise

WHO WE HELP

Taxes Aren’t Just for Office Workers We’ve GotYou Covered

You don’t need a W-2 or 1099 to file taxes or claim valuable credits. We specialize in helping:

Parents with children or dependents

Trusts

Fiduciaries

High income earners

Business taxes

Individuals with cash income

Small business owners & self-employed workers

Freelancers, vendors, and side hustlers

Stay-at-home parents with household income

Anyone confused about how to file taxes properly

People that went tax exempt more than 6 months out the year

Our Services

Remuneration & Performance Income Tax Strategy

We specialize in how you are paid, not just how much. This includes:

Contract pay

Bonuses & incentive compensation

Commissions & overrides

Profit shares

Royalty income

Consulting fees

Private agreements

Non-W2 compensation

Structured payouts

Tax Compliance & Filing

We prepare and file personal and multi-stream income tax returns that are:

Accurate

IRS-compliant

Bank-ready

Lender-ready

Audit-defensible

Income Structuring & Tax Minimization

We don’t just file returns, we help you structure income legally so you keep more of what you earn.

This includes:

How income is classified

How expenses are applied

How multiple income streams interact

How contracts are reported

How families and earners are protected

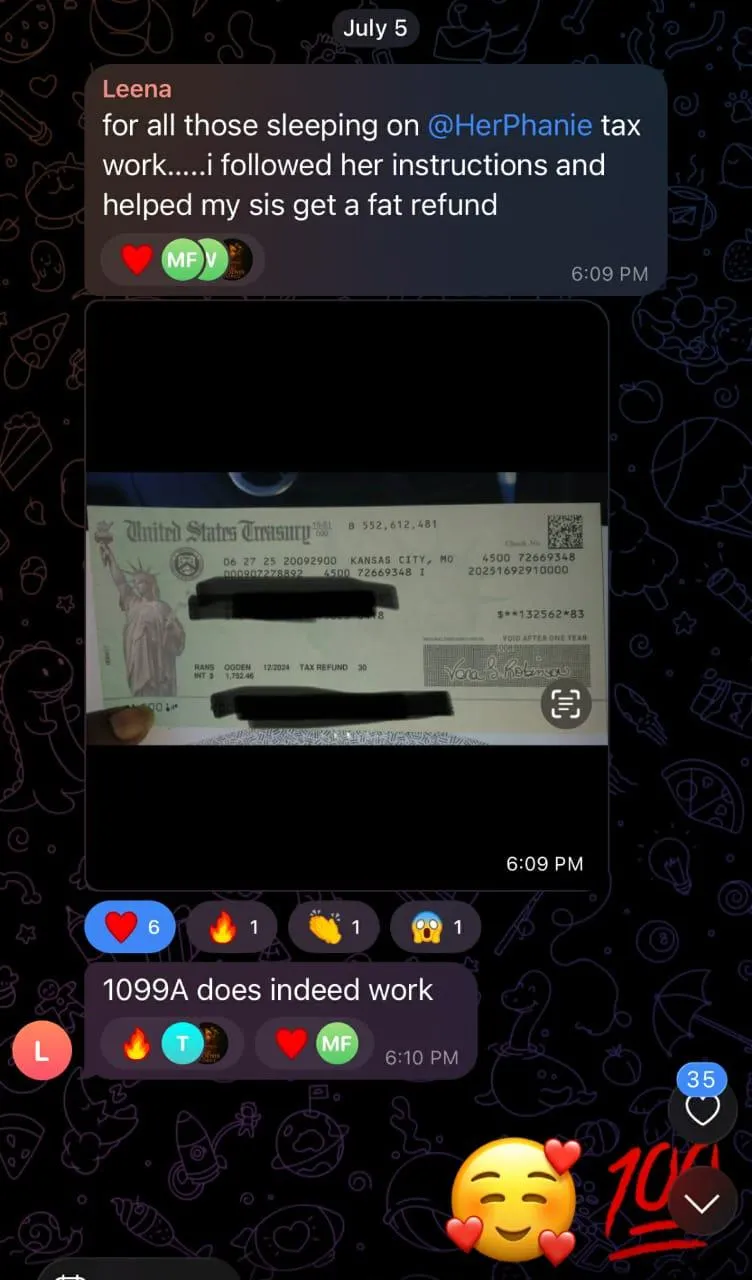

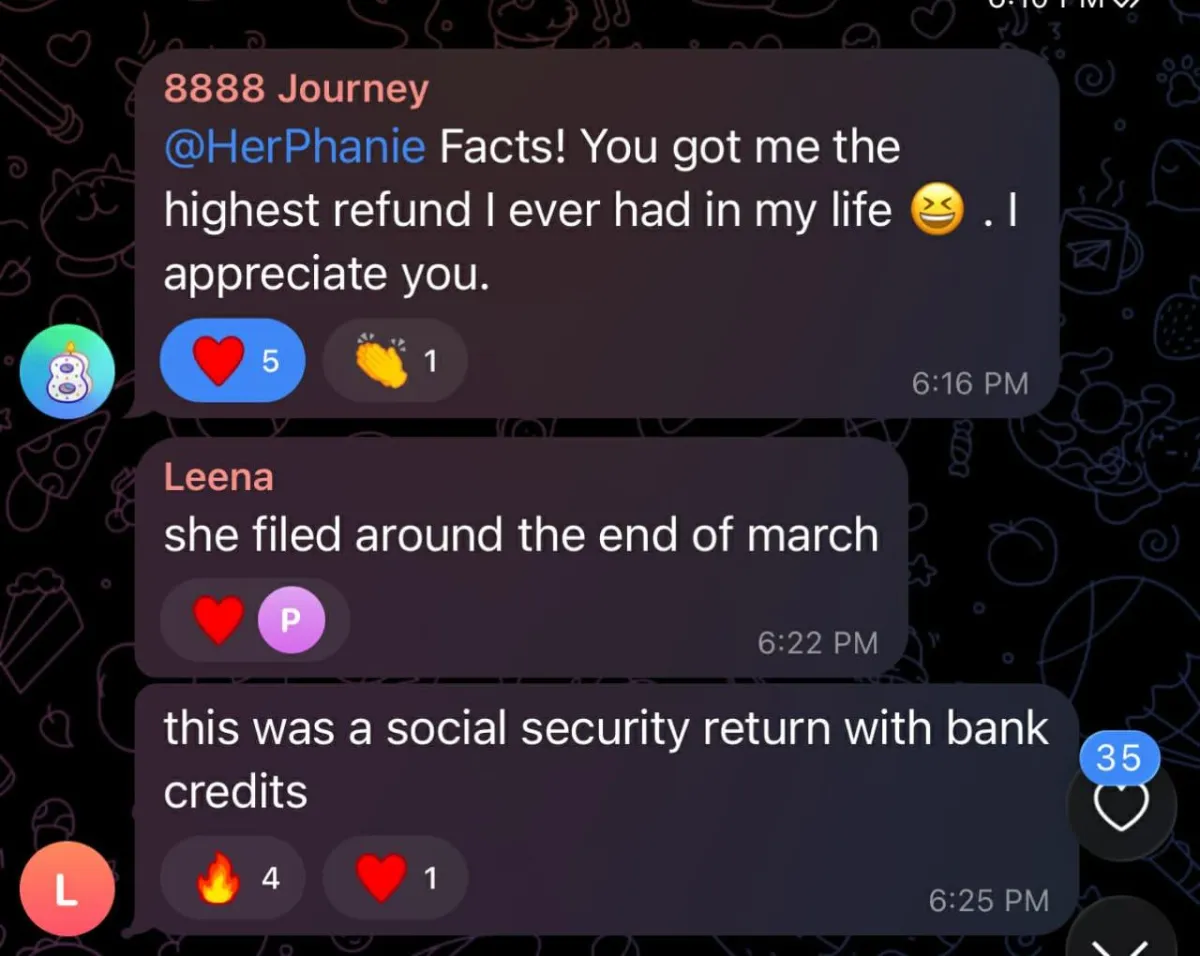

TESTIMONIALS

TRUST & REASSURANCE

You’re Not Alone And You’re Not Doing Anything Wrong

Many people earn income outside traditional jobs. The key is filing correctly, not avoiding filing.

We work with honesty, accuracy, and confidentiality helping you protect your refund and avoid IRS issues.

What We Stand For:

Honest, precise tax preparation

Confidential handling of sensitive financial information

IRS-compliant strategies that protect your refund

Filings that won’t block funding, credit, or future opportunities

Whether you earn cash, run a small business, or support a family we’re here to help.

FAQ'S

Do you only work with W-2 employees? No. We specialize in clients who earn through contracts, consulting, commissions, bonuses, royalties, private agreements, self-employment, and multiple income streams. If your income isn’t simple, you’re exactly who we’re built for.

How can I benefit from your services? Our experts will help you devise a tax strategy that minimizes your liabilities while maximizing your benefits.

What should I prepare for my consultation? Anything related to how you earned income, including: W-2s or 1099s , Cash or contract records , Bank statements , Business or gig income ,Prior tax returns (if available) We’ll help you organize the rest.

What if I get a notice from the IRS? We’re here to help. If you receive an IRS or state tax notice related to a return we prepared, we can assist you in understanding and responding to it.

What does “remuneration” mean in tax terms? Remuneration is how you are paid, not just how much. It includes performance pay, incentive pay, private contracts, cash income, consulting fees, bonuses, and structured payouts. We make sure it is classified and reported correctly so you don’t overpay or trigger unnecessary scrutiny.

Will working with you increase my risk of an audit? No. Our filings are built to be IRS-compliant, defensible, and properly documented. We don’t use gimmicks — we use correct classification, lawful deductions, and accurate reporting.

Do you help reduce what I owe? Yes, legally. We reduce tax liability through proper income structuring, deductions, and classification, not shortcuts or risky schemes.

Can you help if I have multiple income sources? Yes. In fact, that’s our specialty. We work with clients who have two, three, or ten different income streams and need them handled as one cohesive financial profile.